🧠 You Want Your Old Jobs Back? You Sure About That, America?

You say you're bringing back the jobs.

That you're slapping tariffs to defend American workers.

That you’re “rebuilding American industry.”

But we’re watching from Canada — and we’re shaking our heads in disbelief.

We see your resolve for tariffs. We see the inflation on the horizon. And we see the storm coming.

So here’s the deal:

We’re taking a step back. Not out of spite — but just to gain some perspective, to remain sane, to make sense of it all for oursleves.

Let’s go over it one more time.

🔍 You Think You Are Taxing Cheap Import? Think Again.

Here’s the quiet truth: imports feed your economy.

They don’t destroy it — they power it.

Let’s look at 9 real-world products that prove it:

1. 🍅 Imported Tomatoes (Mexico)

Import cost: ~$0.60/lb

Retail price: $2.50–$3.50/lb

Local U.S. value: Port jobs, trucking, cold storage, retail, spoilage control

📘 Source: USDA, Horticulturae (2022)

2. 👕 A Shirt (Bangladesh, Vietnam)

Import cost: ~$4

Retail price: $35–$50

Margin stack: Warehouse → retail → sales → credit → returns

📘 Source: McKinsey, Forbes Retail Markup

3. 🩲 Lingerie (India, Sri Lanka)

Import: $3 → $40–$70 retail

Domestic layers: Branding, boutique jobs, e-comm, malls

📘 JFMM Case Studies

4. 🌀 Washing Machine (Korea, China)

Import: $300 → Retail: $1,100+

U.S. value: Delivery, install, warranty, BNPL, service

📘 PIIE, Home Depot Reports

5. 🍂 Lawn Mower / Leaf Blower

Import: $100–$250 → Retail: $500+

Who benefits? Home Depot, fuel networks, repair shops

📘 OSTI Supply Chain Review

6. 🚜 Excavator (Japan, Germany)

Import cost: $90K

Retail/lease: $140K–$180K

U.S. impact: Jobsite logistics, leasing firms, mechanics

📘 USTR, StatCan Reports

7. ☀️ Solar Panel (China)

Import: $150 → Installed: $600–$800

Ecosystem: Electricians, permits, green financing, SaaS

📘 IEA, OSTI (2022)

8. 🛋️ Furniture (India, China)

Import: $400 → Retail: $1,200–$2,000

Adds value via: Delivery, showroom staff, returns logistics

📘 IBISWorld, CBRE

9. 📺 Smart TV (South Korea)

Import: $180 → Retail: $600–$1,000

Layers of value: Retailers, platforms, returns, insurance

📘 Statista, Best Buy Q3

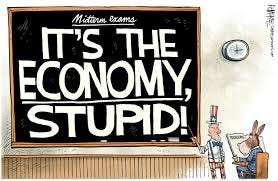

🤯 Tariffs Amplify Consumer Price — For No Good Reason

Even when the tariff cost is small, it gets multiplied:

A 25% tariff on a $4 shirt adds $1 to cost — but $10–$15 at retail, thanks to markup stacking

Same for appliances, tools, tech

Everyone blames tariffs. Everyone adds margin. And consumers get fleeced.

🧪 The Mess You Outsourced — and Why You Don’t Really Want It Back

You didn’t lose those jobs.

You shipped them out on purpose:

👕 Sweatshop labor? Outsourced

🧪 Chemical waste? Outsourced

🏭 Dirty power? Outsourced

🧱 Low-margin manufacturing? Outsourced

All to keep your economy:

Cleaner

Safer

Richer

And now, you’re pretending that’s a mistake?

You Want Those Jobs Back? Be Honest About Them:

🧨 Steel. Aluminum. Cars. You’re Tariffing Yourself in the Foot.

You slapped a 25% tariff on the metals that hold your economy together.

Here’s what happened:

🏭 Jobs “protected” in U.S. metal plants: 140,000

⚙️ Jobs at risk in industries that use metal: 6.5 million

🔻 Job loss risk: ~325,000

💸 Cost added to industry: $125 billion/year

📊 Source: Trade Partnership Worldwide, USTR, PIIE

And in the auto industry?

Cars use $2K–$3K of metals

Tariffs add $750–$1,000 per car

Markup stacks push it to $1,500+ in retail inflation

You made your own cars more expensive, in your own market.

⚡ EVs Are the Future. But You’re Taxing the Future.

Instead of investing in EV tech like China, Germany, and (early) Biden-era plans:

You’re taxing the aluminum, disrupting the battery supply chain, and pretending old-school factories will save you.

You’re not protecting the future — you’re inflating the past.

🛡️ Yes, Strategic Protection Makes Sense — But This Ain’t It

Let’s be clear: every serious economy protects key sectors — from food to semiconductors to defense.

That’s not weakness. That’s realism.

But what you’re doing isn’t smart — it seem political, populist, and inflationary.

Why you’re not building green — you’re protecting the dirty

Why you’re not creating EV resilience — you’re blocking EV competition

You’re not solving the China problem — you’re most likely making your own economy more expensive

There’s a difference between protecting the future — and clinging to the past.

And here’s the kicker:

🤡 The Comedown: From Global Trade Vanguard to Protectionist-in-Chief

You spent 75 years designing and preaching a world of free trade:

NAFTA

GATT

WTO

Bilateral deals

Global supply chains anchored in U.S. consumption

You told the world: “Don’t do tariffs. Do integration.”

You made everyone dismantle their barriers.

You promised peace through open markets.

And now — in 2025 — you’ve become:

The loudest, angriest defender of the very system you told us to tear down.

It’s not just ironic. It’s sounds comical, if it weren’t so damaging.

🍁 Good Luck, America. We’ll Be Over Here in Canada— Building Something That Works.

Now that the U.S. has imposed tariffs on almost everyone — including new ones on Canadian products — we’ve hit our pivot point.

We’re still hurting. We’re still exposed.

But we’ve made our choice:

We’re not getting dragged into your economic suicide.

Canada’s Pivot

📈 We’re got to be investing in our own infrastructure

🏗️ We’re using our (massive) fiscal room

🌱 We’re hoping to keep an eye on the future , not past

🧠 We’re probably going to trust folks like Mark Carney and grown-up economists, though jury is still out.

And Yes — We’re Still Learning

You did us a favor.

You made us pay attention.

You made us question.

You made us wake up.

We’re not fully awake yet — but we’re getting there.

And we’re not falling into the same populist traps you are.

🧠 Final Word (Watching You from Canada):

We’ll trade with you. We’ll learn from you.

We have said enough, and we wish you good luck, honest, Canadian courtesy.

We want you to succeed, even though we think you are making a mistake!

But we’re not following you off a cliff.

We will still be here, when and if you decide to make a U turn.

We have our own challenges – housing, health, affordability, social integration, truly reconciling with indigenous nations, Arctic…

We are hoping to learn from everyone who can offer a lesson or two, we sure hope to listen.

We would like to build something different — something a little more boring, a little more grown-up, something in real world, and maybe —— something that works.

It has been great growing up with you, even as we grow independent and apart for now.

📚 Sources & References

Trade, Tariffs & Manufacturing Costs:

Trade Partnership Worldwide (2018). Estimated Impacts of Retaliatory Tariffs on the U.S. Economy and Jobs.

Full Report (PDF)Peterson Institute for International Economics (2019). Trump’s Washing Machine Tariffs Cost Consumers $1.5 Billion.

Read HereU.S. International Trade Commission (USITC). Economic Impact of Section 232 Tariffs on U.S. Industries (2020–2023).

USITC PortalMcKinsey & Co. (2020). The State of Fashion 2020 Report.

Read ReportStatista. U.S. Smart TV Retail Markups and Supply Chain Breakdown.

Statista TV EconomicsCRS / Congressional Research Service. U.S. Auto Industry Supply Chains and Policy Risks.

CRS Reports

Carbon, Globalization, and Labor Dynamics:

OECD (2020). Carbon Embodied in International Trade – Annual Report.

OECD Carbon Trade AnalysisJ.R. Haft (2015). Unmade in China: The Hidden Truth About American Jobs.

Book on GoogleBrookings Institute (2021). The Future of Work in Post-Industrial Economies.

Brookings ReportWorld Bank. Labor Exploitation and Trade Data Dashboard.

WB Labor Tools

Sector-Specific Studies (Products in Section 2):

Cui et al. (2022). Global Tomato Trade and Canadian-U.S. Logistics Chains. Horticulturae, 8(12).

MDPI JournalYork University (2022). Appliance Distribution and Installation Supply Chains in Ontario.

YorkSpace PDFJournal of Fashion Marketing and Management (JFMM). Global Apparel Margins and Supply Chain Behavior.

JFMM at Emerald InsightOSTI – U.S. Office of Scientific and Technical Information. Lawn Equipment and Farm Machinery Value Chains.

OSTI Agricultural Equipment Supply ChainIEA (International Energy Agency). EV and Solar Panel Cost and Deployment Trends (2023).

IEA Global OutlookIBISWorld (2023). Furniture Retail in North America: Cost Breakdown and Value Chains.

IBIS ReportsCBRE Research (2022). Warehousing and Final-Mile Logistics for Retail Furniture.

CBRE Report

Policy & Institutional Sources (Canada + Global):

Bank of Canada & Mark Carney Speeches. Fiscal Resilience and Strategic Industrial Policy.

BoC ArchivesFederal Government of Canada Budget 2024–25. Infrastructure, EV Strategy, and Domestic Value Chain Investments.

Canada.ca Budget PortalGerman Federal Ministry for Economic Affairs (BMWK). Debt Flexibility and Industrial Base Preservation.

BMWK Industrial Strategy